Shop By Category

Featured Products

From €28,207.87

why should I invest?

Gold has always been greatly appreciated. Not only for its inherent aesthetic qualities, but as a standard of value as well. The warmth and light glow of this precious metal has been a source of inspiration for mankind for over 3000 years: from the very beginning of its usage in weapons and jewelry, all the way through its use a payment currency in the form of a coin. The fascination with gold and its endless possibilities remains unshaken: this metal is always in high demand and is considered timeless.

Gold’s uniqueness is its resistance. It survived all financial crises to date and remained valuable. Gold, unlike cash or stock shares, cannot be reproduced at will. It is a finite natural resource that is resistant to inflationary financial politics. Due to its limited availability, the value of gold will increase over time.

Gold us highly demanded in various industries as well. Over the past decades the use of gold, alongside with other precious metals, such as platinum, palladium and silver, has been escalating in numerous industries, including automobile, electronics, space, medical etc. Gold remains a safe option for long-term capital investment, due to its wide range of qualities, usefulness and historical significance.

“Gold Is Money, Everything Else Is Credit” –JP Morgan

Current market offers two options for capital investments. First variant – bars of five, ten, hundred or thousand grams per fine ounce. Alternatively, it can be used it the form of investment coins. Coin trading shop is a platform allowing collectors, merchants, private and institutional investors and financial advisors to buy or sell both gold trading options.

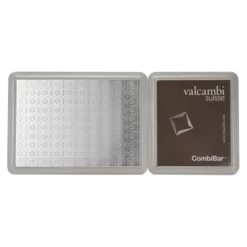

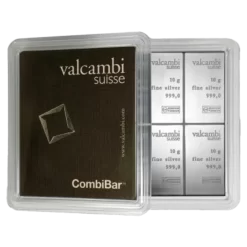

We acquire our gold and silver bars, as well as trading coins, from the most reputable producers. Also, our qualified experts carefully examine each and every item to ensure the highest quality of all our products. Coin collectors have the opportunity to expand their portfolios through our extensive assortment of gold and silver coins obtained throughout world. All at reasonable prices.

At coin trading shop buyers have the opportunity to attain gold at low costs, close to the current gold price. The size of the investment does not make a difference. Our assortment is updated daily, according to the current market price for gold, thus ensuring low prices. Moreover, wholesale price is available to bulk buyers. Our expert team will be happy to assist every interested private person, as well as merchants and investors. We will gladly share our extensive knowledge of the precious metals trade.

Why invest in gold, silver and platinum group metals?

As per above, experts predict gold and other precious metals to be on the rise in the future. All natural resources, including gold, are finite. Silver is predicted to be exhausted within 30 years. However, its demand will remain. This will positively affect the prices for gold and silver. For this reason, both metals are a strong financial cornerstone it these times of political and financial instability, as well as rising inflation. Gold in particular is a highly stable article and will never lose it value. For this reason, gold is considered to be the most suitable asset for investment.

Procuring gold and silver coins is no longer favorable solely to collectors. During the past years private investors have also discovered coins as a solid investment and excellent retirement arrangement. Gold, in its physical form, guarantees an immunity to inflation. Coins are an easy method to increase invested amounts, while bars are more often used to secure large assets.

Primary interest when purchasing gold is, of course, is its purity level, however, coins are also valued based on their public profile (issue year, mintage, quality). Coins are traded in various sizes and categories and their price depends on current rate of gold.

Bars, gold and silver alike, are an older trade form of precious metals. Their worth is based solely on their purity level and weight. In contrast to coins, neither design, nor the brand have any influence on the price.

Current trading prices of precious metals are subject to changes and are determined by supply and demand of natural resources. Daily price, combined with the merchant premium, forms the base for the trading price. Merchants there add on their costs for marketing, storage and distribution, insurance.

Coin trading shop, however, dispenses with a large storage stock and obtains gold bars and coins directly form the leading producers and coin mints, cutting out intermediaries and, thus, affecting prices favorably to the purchaser. All items can be acquired online, and their availability can be checked any time via telephone or email. The goods will be dispatched within 24 hours of payment receipt.

Many investors chose not to limit their portfolio to gold only. Gold market is relatively stable in comparison to silver, which is strongly influenced by economic fluctuations. However, silver will grow in value in the future as well, due to its vitality in mobile and computer markets.

Long term investors also take interest in palladium – a lot less popular trade metal. It’s a crucial resource in nano-technology based industries and palladium value has grown strongly and is almost unchanged. Due to its low extraction costs and naturally grey color, this precious metal has found its place in jewelry and automotive field. Because of palladium’s usefulness in various industries its rising price is closely tied with the demand for gold and silver.

Investors with cyclical economic foresight also value platinum. It is an indispensable resource in automobile industries. As the automobile industry grows and gains more success, the need for platinum grows accordingly. Thus, securing stable value. Platinum is the rarest precious metal of all known to mankind, in spite of being discovered only 250 years ago. Platinum is being mined roughly 30 times less than gold, but is significantly purer. High quality gold’s purity is roughly 75%, whereas platinum reached 96%. Even tough platinum is a fairly recent precious resource and its mining volume is only around 130 tons per year, it is a key element in modern science and numerous industries. Platinum holds the potential of surpassing gold price wise, bearing in mind its price has been deviating positively from the price of gold. Platinum is also called the „mother of metals“.

It does not matter which precious metal you feel suits your requirements best, our expert consultants will be happy to assist with your investment over the phone or via email. Our substantial portfolio offers a wide range of various investment opportunities, to suit everyone’s needs. We invite you to take your time getting to know precious metals and becoming expired. Feel free to inform yourself over the next few following pages…

Lietuvių

Lietuvių Polski

Polski Русский

Русский